Thank bipartisanship for long-awaited end to “Doc Fix”

House Speaker John Boehner (R–Ohio) and Minority Leader Nancy Pelosi (D–Calif.) are claiming passage of a bill that does away with the Medicare Sustainable Growth Rate (SGR) as victory for their respective parties. The Republican-controlled House passed HR2, The Medicare Access and CHIP Reauthorization Act, which will be voted on by the GOP-led Senate after spring recess.

Congress’ 18-year delay of Medicare provider payment cuts — otherwise known as the “Doc Fix” — is being replaced by a 0.5 percent provider payment increase over the next five years and changes to member premiums thanks to a bipartisan effort that is by no means the norm in today’s polarized political climate. The reform also calls for restructuring payment models to be based more on quality of care.

The Associated Press (AP) reports the reform will cost $210 billion over the next 10 years, with two-thirds of it being financed by other federal deficits. Medicare members and providers are expected to cover the other third, which comes out to about $70 billion.

According to AP, Medicare Beneficiaries whose incomes are $134,000 or higher will see increased premiums for medical services and prescription drugs starting in 2018. By 2020, the proposed law will require seniors who purchase Medicare Supplements to pay a minimum out-of-pocket cost of $147. Currently, the popular Plan C and Plan F Supplements usually have a $0 out-of-pocket cost.

Concern over increases in higher-income member’s monthly premiums and increased out-of-pocket costs has been expressed by Democrats as well as AARP and other senior interest groups.

The New York Times reports Judith A. Stein, executive of director of Center for Medicare Advocacy, said the reform package “Asks too much from beneficiaries and nothing from the pharmaceutical or insurance industry.”

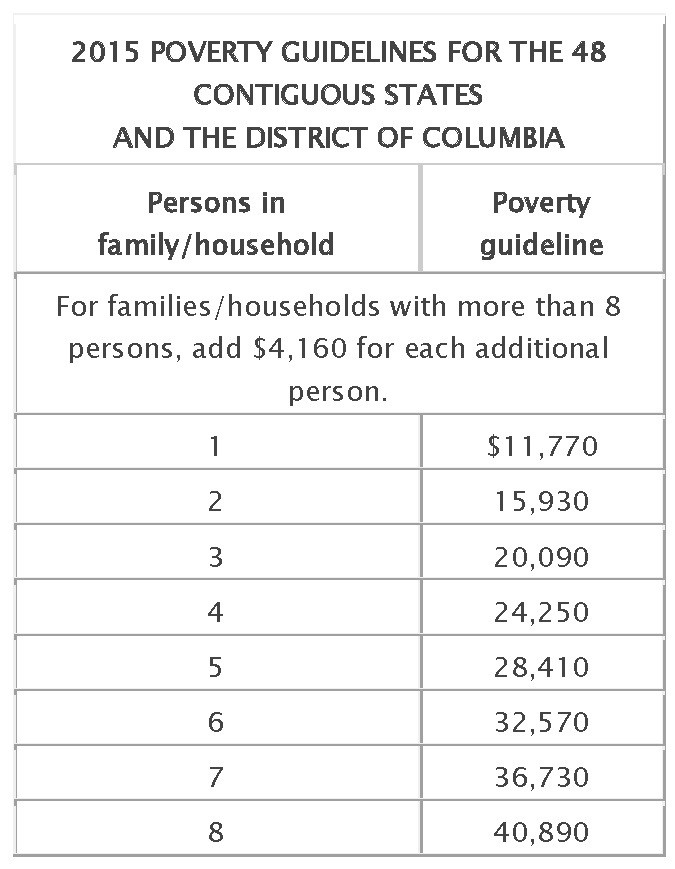

A Kaiser Family Foundation FAQ says the bill permanently extends the Qualifying Individual or QI program, which provides premium payment assistance to low-income seniors.

Language related to the Hyde amendment, a 1979 provision annually renewed by Congress to restrict federal funding of most abortion services, cast doubt over the bill’s passage last week, just as it delayed passage of an anti-trafficking measure debated in the Senate earlier this month.

President Obama has endorsed the reform, which also includes provisions for the Children’s Health Insurance Program, Medicaid, funding for community health centers and funding for rural hospitals. The Senate is expected to pass the reform after it returns from a two-week-long-spring recess.

RB Insurance specializes in selling Special Needs Plans for individuals eligible for Medicare and Medicaid, including those eligible for the QI program. Learn more about QI and expanding your Book of Business by assisting low-income Medicare members by clicking here.