How do federal poverty guidelines affect your Book of Business?

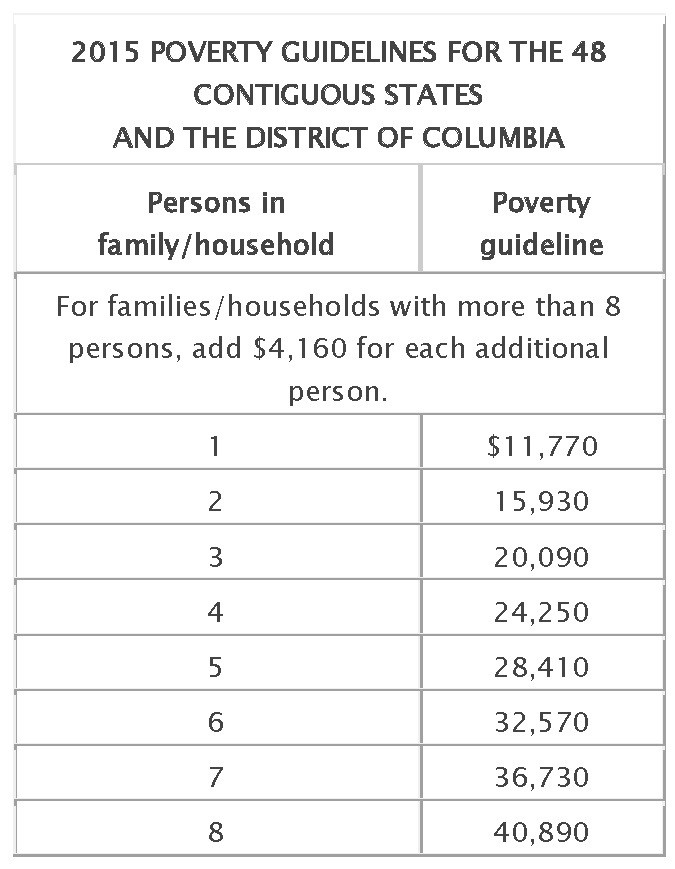

Each January, the Department of Health and Human Services adjusts the poverty guidelines most federal and state programs use to establish eligibility criteria for assistance programs to reflect changes in the Consumer Price Index. These guidelines are sometimes referred to as the federal poverty level or “FPL” by Agents. The FPL can be your opportunity to help an underserved population and grow your Book of Business.

Most state Medicaid programs that take the FPL into account are required to update their eligibility criteria by April 1 to reflect the annual adjustment. In the senior insurance business, states set the eligibility criteria for Medicare Savings Programs or MSPs, which help seniors with their Medicare premiums and cost sharing. The different MSP classifications correspond with a percentage of the FPL.

For example, Qualified Medicare Beneficiaries (QMBs) earn less than 100 percent of the FPL; Specified Low-Income Medicare Beneficiaries (SLMBs) earn less than 120 percent of the FPL and Qualified Individuals, otherwise known as QI-1s, earn less than 135 percent of the FPL.

The FPL is also used for the federally facilitated Health Insurance Marketplace and the 13 state-run health exchanges to determine eligibility for subsidies that lower the monthly premium cost of a health plan purchased from either of the two.

For example, anyone with a QMB status has an annual income that is lower than 100 percent of the FPL is eligible for the following benefits:

• Payment of Medicare Part A (if not free) and Part B premiums

• Payment of Medicare co-insurance and deductibles

All states add what is called a $20 income disregard to the FPL to determine MSP eligibility. For instance, if the FPL for an individual is $981 this year, the allowable income is increased to $1,001. This is the income amount you will be looking for to help your clients determine if they are eligible for assistance through one of the MSPs.

Another example for you: Individuals who make more than 100 percent of the FPL, but less than 120 percent would be considered SLMB and receive payment of their Part B premium, but no other benefits from the state.

Low Income Subsidy or the LIS also uses the FPL for calculation of its initial income levels for Medicare beneficiaries.

Under the Affordable Care Act, a family of four can make up to 400 percent of the FPL and still receive premium assistance from the government for the plan they purchase in the Health Insurance Marketplace or their state’s exchange (Remember, you must be certified to sell Marketplace plans). The assistance is only valid for plans purchased through either the federal or state exchange.

If you want to go the extra mile for your clients, the first thing you can do is find out more about different assistance programs available in your state. The second thing you can do is help your clients enroll in Low Income Subsidy and encourage them to fill out their Medicaid application to pay for their Part B premium. $1,200 back into a customer’s pocket is a huge deal when they are on a fixed income and make less than $1,000 per month. Never assume clients know about or are receiving all of the benefits they are entitled to.

Feel free to contact me at (800) 997 3107 or email me if you are interested in learning more about the FPL or Medicare Savings Programs. Subscribe to our blog to read more of my posts about outstanding sales opportunities with the dual-eligible market.